Sometimes it's best to start off small and easy, that is true for fitness and finance. With the new year approaching, many of you will be setting goals to save money. It sounds like a great goal (and IS a great goal) but if you don't really have a place to start it's overwhelming. You could do a no spend challenge but that might be a little bit too extreme for some. You could also start our beginner money saving challenge that puts you on a path to save $500 in six months but I want you to have bigger goals and accomplish them faster! You CAN do this!

This three-month money challenge will have you saving $600 by the end of the challenge. In order to do this, you will be saving $50 per week. This amount may sound easy for some but hard for others. I am confident that the majority of you CAN make this work.

In order to save the $50 per week, you will want to look at your expenses. This could be something as simple as quitting your morning drive-thru coffee habit (save at least $28 per week) and/or eating out for lunch or dinner (save at least $70 per week). No matter what time of year you are starting this challenge, you will likely have a holiday come up. Just because it's a holiday on the calendar doesn't mean you have to buy gifts or spend money. If you want to make the holiday special, do something with your loved ones! There are many free options and, again, gifts are NOT required. Another idea is to go through your bills and cut out unnecessary expenses. Maybe you can downgrade (or eliminate) your cable or you could lower the data you pay for on your cell phone plan. Every little bit adds up! You could also come up with this $50 per week by selling items that you no longer use or need. Each person will have their own journey so personalize this to you! Most of all, do not give up!

Interested in more money saving challenges? Try one of these:

3 Month Money Saving Challenge

Beginner 6 Month Money Saving Challenge

52-Week Money Saving Challenge

12 Month Money Challenge

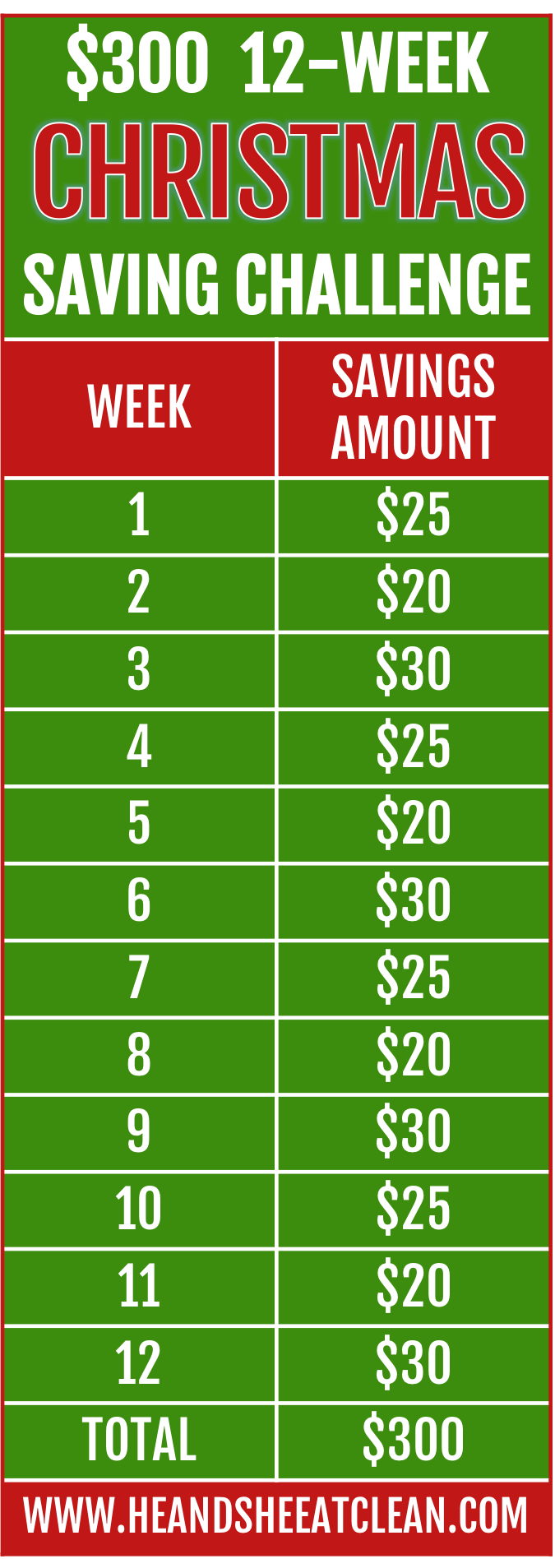

$300 12-Week Christmas Money Saving Challenge

Looking for a printable version of this challenge? We've got you covered! Join our newsletter and you will be taken to a black and white printable version right away! Grab the printable challenge here.

The $50 per week breaks down to $200 per month but that can seem like a lot of money per month so I like to break it down into weekly goals. :) But if you like to think of it as $200 per month, go right ahead. Do what you need to do to accomplish your goals!

![#ProgressIsPerfection [3 Simple Ideas to Reach Your Goals]](https://images.squarespace-cdn.com/content/v1/555c964fe4b07d15252a8927/1520969172984-7HDOHI6ZRM0PCZCZ7O67/progress-is-perfection-silk-he-and-she-eat-clean2.jpg)