A Little Background:

I grew up a saver, maybe you could even consider me an over-saver. I never wanted to spend money. I hated shopping, I didn't want to spend money on traveling...I never wanted to buy anything. My parents had a part in my frugal ways but a lot of it came from my grandparents who watched me during the day while my parents worked. They were depression-era. My grandfather actually rode to Lilburn, GA on a horse and buggy from Dahlonega, GA way back when. He worked for Ford for years during the day and farmed in the morning before work and again after work. They saved everything they had, because it was all they knew. I loved them more than I can ever express in this post and wish every single day they were still here with me. However, they both passed before I even turned 18. What they taught me has stuck with me until this day. RELATED: Read more of Whitney's story here.

Living a balanced life requires saying "no" more than saying "yes". This applies to finance and fitness. It is not about deprivation, it's about self-control.

Scott comes from quite the opposite so he was always more of a spender than me. We met in the middle and that is where we basically stand today. Not to say that we don't still argue from time to time over what we should or shouldn't buy. ;-) We don't want to clutter up our house or lives with needless purchases when that money could be saved for a plane ticket, rafting trip, etc. You won't find us with the newest TV, expensive cars, or 100 pairs of shoes. However, we don't deprive ourselves. We have plenty of workout clothing, shoes and hiking gear because we use them all the time. I probably have more hiking pants than I do regular pants. When we do purchase something we try to find the highest quality and really do think about where it was made, how it was made, etc. I'm not saying we are perfect but we do try to be aware.

We are approached by a lot of companies to produce sponsored content and we do work with some companies but we are very picky about the ones that we do work with. Each opportunity we consider we also evaluate how it aligns with our minimalist philosophies. We aren't going to push every product that is sent our way unless we do think it will add value to your life.

Debt:

Let me back-up a little bit. When we got married, we did as everyone else does - we registered for all the kitchen items, fancy china, a million throw pillows, bedding, etc, etc, etc. We "collected" DVDs (that we would buy really cheap) and I even collected Monopoly games.

Scott had student loans and we also purchased a home the same month as our wedding. Shortly after getting married we threw all of our "extra" money at Scott's student loans and paid those off within a year.

My car was already paid for when we got married and so was Scott's. After a few later Scott got a brand new truck which eventually was traded in for a brand new Jeep Grand Cherokee Overland. We loved the Jeep but we had a payment on it and didn't really need it. Scott only works eight miles away and he didn't even drive it when it rained! We decided to sell it and get something that we could pay for in full. The savings from the Jeep payment each month is enough to buy a plane ticket once a month! If you haven't noticed, I like to think in terms of plane tickets. ;-)

We don’t have car payments. We don’t have credit card debt. Is it hard? Yes. Is it worth it? Yes. We now have no debt other than our mortgage payment. We do want to sell our house and get a much smaller house (around 800 sq ft) that we can pay for in full or pay off quickly.

RELATED: 5 Money Quotes to Motivate You

Decluttering:

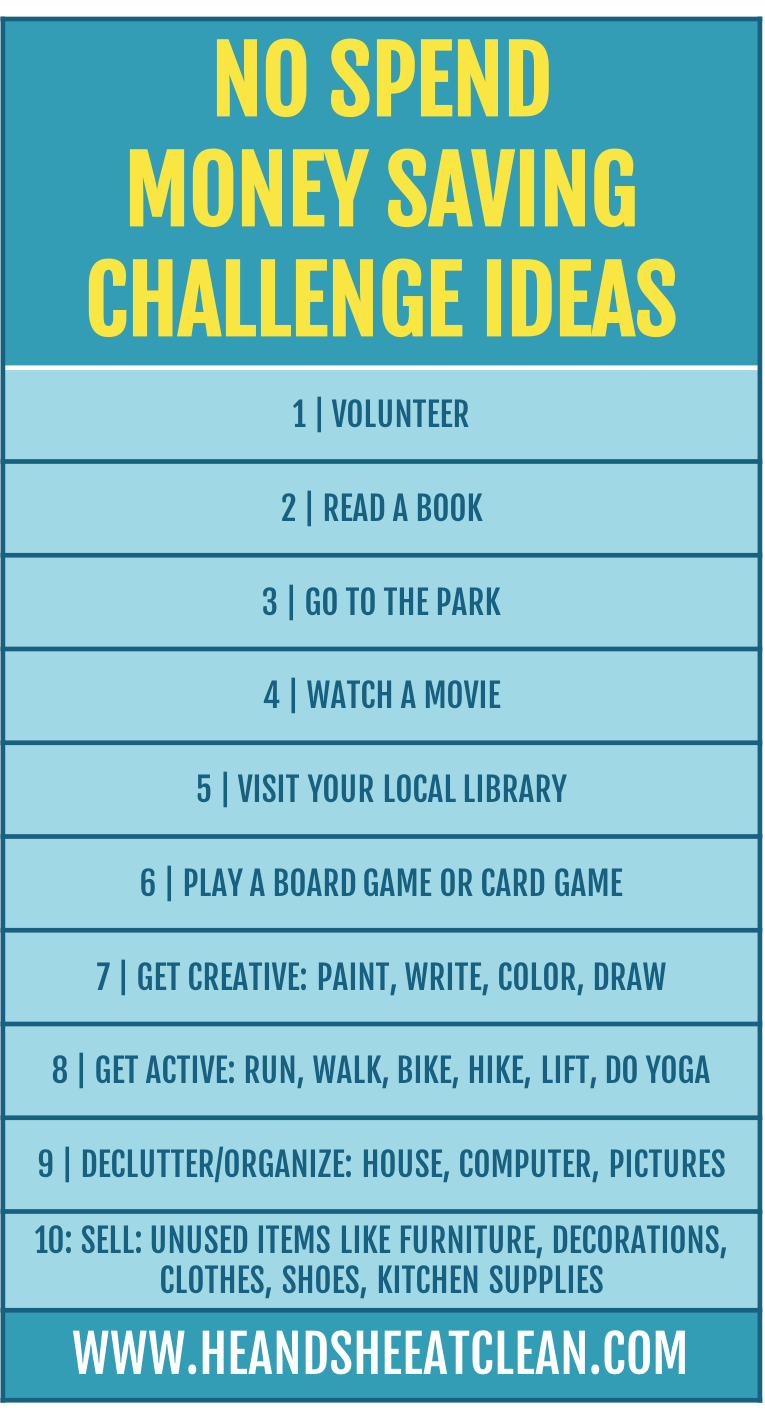

As far as the clutter in our home, ever since I left my office job in 2013 I started de-cluttering our house but I still have a long way to go! I started room by room. First up was our bonus room above the garage that "we just had to have", although we never use it. I sold a TV, TV stand and almost all of our DVDs up there. We gave the couch to a family friend and now that room basically houses our litter boxes (i.e. totally wasted space). Then I moved onto other areas of our house. I de-cluttered our kitchen when we installed new countertops. We have three bedrooms and we had beds in all three, although I'm pretty sure the guest bedrooms have been used maybe three times in the almost nine years we've had the house (i.e. totally wasted space). I decided to turn one of the bedrooms into my office so I sold all of the furniture that was in the room and bought a stand up desk. Then I moved onto the dining room. I wasn't really a big fan of the dining room furniture we had anymore and wanted something more rustic. We sold all the furniture on CraigsList and I even sold all of our China (that we never even used ONCE) on eBay. Now our dining room is actually a place where we can display things from our trip and other pictures that previously had no place to live. Selling the China and furniture actually paid for our trip to Jackson Hole last year.

I'll go into ways to get started in a future post but as the quote below states, the most basic way to get ahead is to spend less than you earn.

![#ProgressIsPerfection [3 Simple Ideas to Reach Your Goals]](https://images.squarespace-cdn.com/content/v1/555c964fe4b07d15252a8927/1520969172984-7HDOHI6ZRM0PCZCZ7O67/progress-is-perfection-silk-he-and-she-eat-clean2.jpg)