We're wrapping up our Detox Your Money Challenge with 3 simple money habits that changed our lives! We aren't done sharing money tips though, be on the lookout for more coming soon!

>>>> If you feel like you need to detox your money, get help here.

3 Simple Money Habits That Changed Our Life

1. We avoid buying on impulse. If we do, we return it.

Impulse buys, whether they are at the grocery store, department store, or gas station, can eat up a large chunk of your budget without you even really realizing it. If you are out with friends and decide to stop and get a coffee, there goes $4. Then you pick up a few items at the checkout at the grocery store and there's another $10. These small expenses really add up over time.

We aren't immune to these. I would say that Costco is the place where a lot of our impulse buys happen (maybe because that seems to be the place where we spend our time shopping!). We will end up with a lot of stuff we needed and quite a few things we didn't. Once we get home we realize we probably didn't need another flannel shirt or more bowls so we return the items we don't use. As long as you haven't used something and it fits within the store's policy, there's no reason to not return something you aren't going to use.

2. We spend less than we earn.

This one sounds easy but tends to be the hardest for people to accomplish. Your main bills (mortgage/rent, utilities, etc.) should be pretty consistent each month. Figure out what those are, then add in the variable expenses like groceries. This is the minimum amount of money that you need to make. If you don't make that money at your current job you have a few options or a combination of options. You can find a way to reduce those expenses even more, look for another job, a second job, or start selling things you don't need or use. We made thousands of dollars last year selling things we no longer used.

If you do have extra money left over after your bills, use it to pay down debt, start an emergency fund, or save for retirement! Keep in mind while shopping that it doesn't matter how good of a deal it is if you don't need it!

This might be a good place to mention that we actually DO use credit cards. We actually use credit cards for every single purchase we make. The difference is that we pay them off in full every single month. We use them to accumulate points for cashback and/or travel. Credit cards are often times more secure than debit cards as well. This strategy only works if you actually pay them off in full every month. If you rack up credit card debt in the name of getting points the amount you pay in interest will likely outweigh any credit you receive.

3. We don't care about what other people are doing or buying.

This is commonly referred to as keeping up with the Joneses. We've both always had our "blinders" on when it comes to what other people are doing. We don't care about what kind of house, TV, car, etc that someone else has. We focus on our goals and what we need to do to accomplish them. Trying to keep up with what other people have will leave you broke and exhausted. Keep your focus on you and your family.

I hope these give you a fresh perspective and try to incorporate them into your life. You may also be interested in 3 Simple Fitness Habits That Changed Our Life and 3 Simple Eating Habits That Changed Our Life.

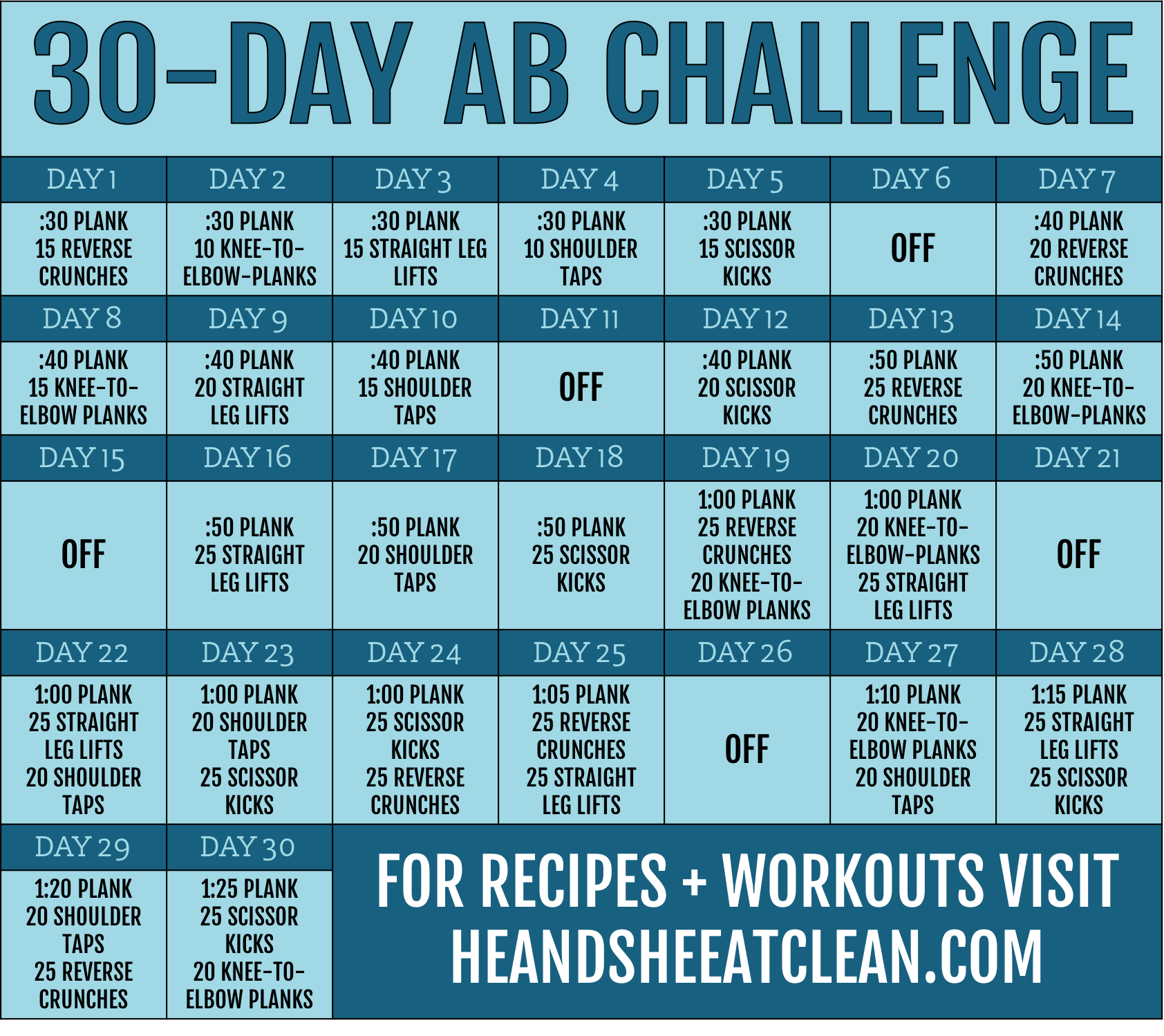

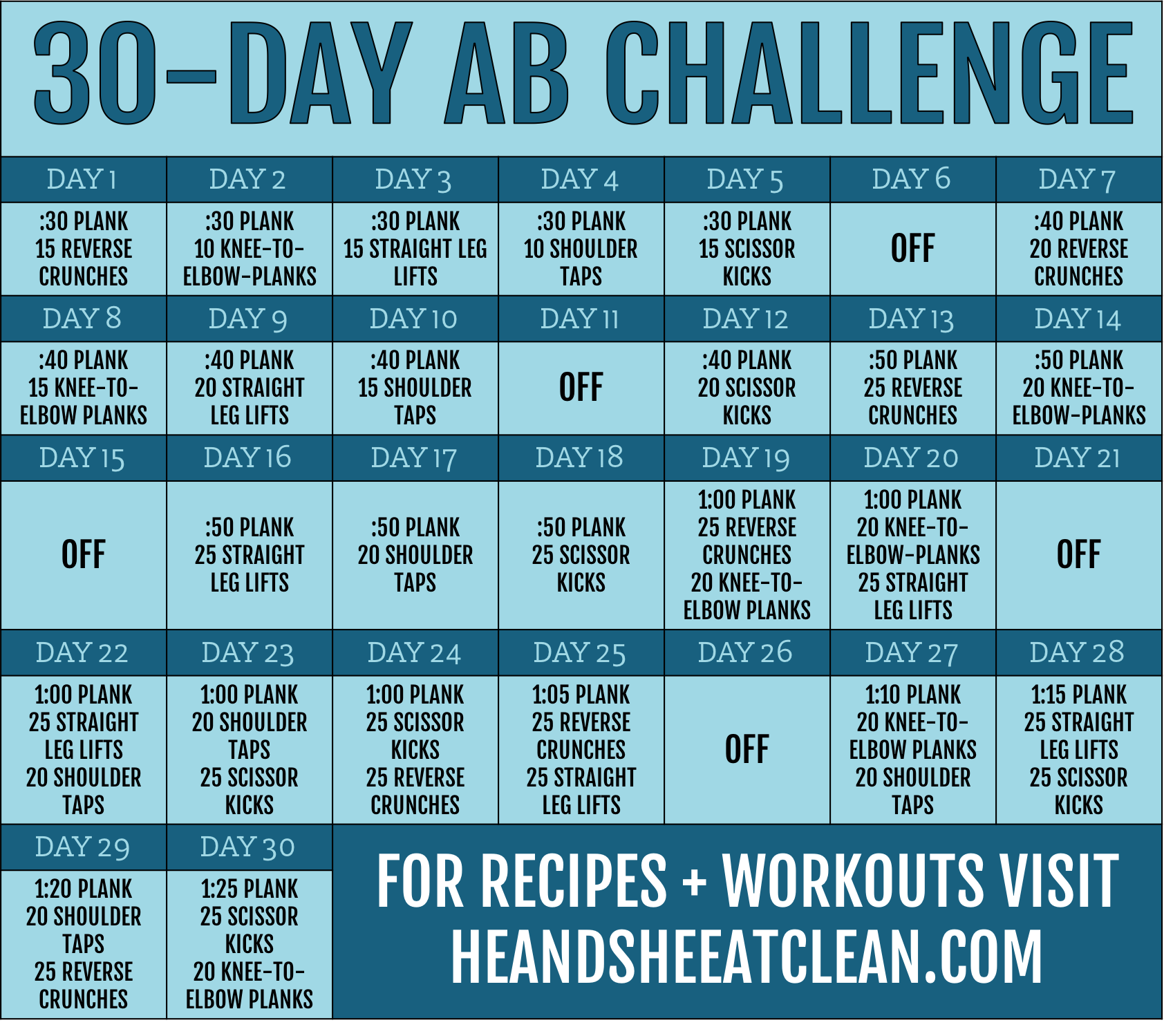

Join one of our popular Money Saving Challenges and read through more finance related posts below!

RELATED:

![#ProgressIsPerfection [3 Simple Ideas to Reach Your Goals]](https://images.squarespace-cdn.com/content/v1/555c964fe4b07d15252a8927/1520969172984-7HDOHI6ZRM0PCZCZ7O67/progress-is-perfection-silk-he-and-she-eat-clean2.jpg)